BENEFITS OF PAYING RENT WITH A CREDIT CARD

Rent is an inescapable expense, making the payment and the mode of payment a crucial factor for an individual. Have you ever used a credit card to pay the most typical monthly bill, i.e. rent? Credit cards can save you if you are low on cash. Rent payment is actually more convenient with a credit card, because not only are you paying your rent without disturbing your monthly budget but you can also increase your credit score and get additional benefits via different credit card rent payment offers that different credit card companies offer. Let’s see in detail why you should pay your rent with a credit card.

- Timely payments:

Payments can be made quickly and on schedule without concern for a lack of funds or interference with your monthly budget. Rent payments can be automated with credit cards, ensuring that it is paid on time each month. The inconvenience of writing checks or making electronic payments each month is also avoided by automating rent payments.

- Reward points:

One of the main benefits of using a credit card for any transaction is the reward points that can be earned. Unlike cash transfers, credit card charges allow you to accrue extra reward points that may be used to buy anything from gift cards to vacation packages to airline tickets. Also Checkout: Best Rewards Credit Cards in India 2022

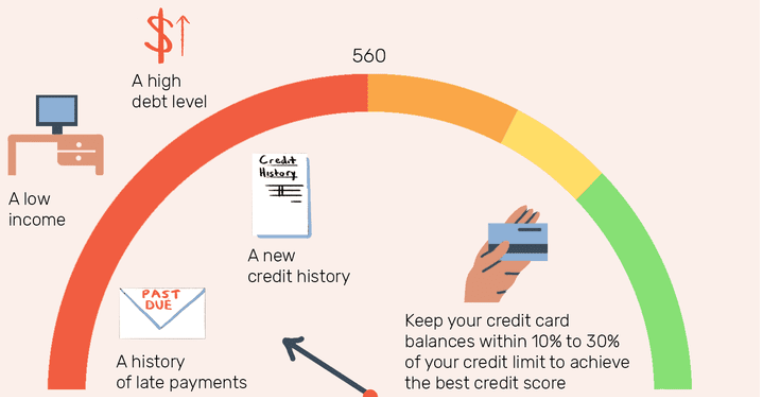

- Can boost your credit score:

The majority of banks and financial institutions consider a person's credit score when determining whether the person is qualified for a loan or not. Regularly using your credit card for large transactions will help you keep up a solid credit score. Paying rent by a credit card may be the most convenient approach to keep your credit score and credit history strong if you can make your credit card payments on time.

- A boon if you’re in a financially tight spot:

Credit cards can be used for any purchases or transactions in the event of an emergency where there is not enough cash on hand. Credit cards are a lifesaver for anyone who finds themselves in a bad financial situation.

- Cashback:

When you make a purchase, you receive a portion of the price as a reward. These rewards also come in the form of cashback. Travel discounts, cash back, or other credit card incentives are one strong reason to pay your rent using a credit card.

Also Checkout: Best Cashback Credit Cards in India 2022

Before using a credit card to pay the rent, it is vital to take into account a number of things. It's crucial to pay off your credit card balance in full because doing so will raise your credit rating, and will also help you earn various rewards and cashback. In the event that the credit card bill is not fully paid, high-interest rates are also charged.

Additional Reading: Major Factors that affect your CIBIL Score

.png)

Comments

Post a Comment