Major Factors That Affect Your CIBIL Score

A credit score is a crucial factor that is reviewed when you apply for a credit card or for a loan. It is a 3 digit number that determines your credibility. Here are some major factors that can affect your CIBIL Score that you must be aware of. Keep reading to kick start your research.

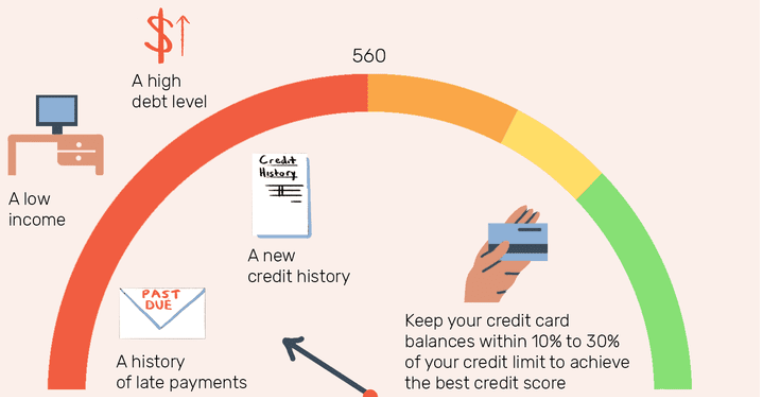

Not paying credit card bills on time: It is crucial to pay the credit card bills on time and in full. If you keep defaulting in the repayment cycles then it will affect your credit score negatively. To avoid this from happening you can choose to register for the auto-debit services and you do not have to worry about remembering the due dates.

The high credit utilization ratio: Another important aspect that you need to keep in mind is not using your credit limit completely. It is advisable to maintain a credit utilization ratio between 30% - 40%, more than this will eventually harm your credit score. To avoid this situation you can set a threshold limit on your credit card so that on reaching that limit you get a notification on your account and you stop using your card for further purchases.

Outstanding debt: Keeping outstanding debts is not good for your credit score. Debt not only includes credit card bills but other debts like personal loans, etc. also can affect your credit score badly. Make a list of your debts and list them as priority wise and then start clearing them one by one this will also help you in building a good credit score.

Paying only the minimum due amount: If you think that paying just the minimum amount due can help you avoid the interest rates then you are wrong. Paying the minimum amount due will only help you avoid late payment charges. The rest amount will still accrue interest and the chances of leading to a debt trap also increase. And thus, it will directly impact your credit score negatively.

Multiple credit card applications: Sending multiple credit card applications will going to generate hard inquiries against you. Do not send multiple applications, it is advisable to maintain a gap of 6 months between two applications. If your application is rejected the first time then wait for another 6-7 months and then reapply till then work on your profile to make it strong so that you can get a credit card easily the next time. Sending multiple applications will affect your credit score.

Errors in the credit card statement: You need to check your credit card report/statement once in a while. Checking them helps you keep on track about all your transactions. Any error or omission on your credit card statement/report can affect your credit score negatively. Also, keeping track of them helps you report them to the credit card issuer immediately so that they can be rectified.

Closing old credit cards account: Never ever close your old credit card account as you will lose all your credit history. Losing a credit history will lower your credit score. It’s better to use them for small purchases every now or then as it will also help in improving your credit score and building a good standing account.

Comments

Post a Comment