How Much of The Credit Card Balance Should I Use?

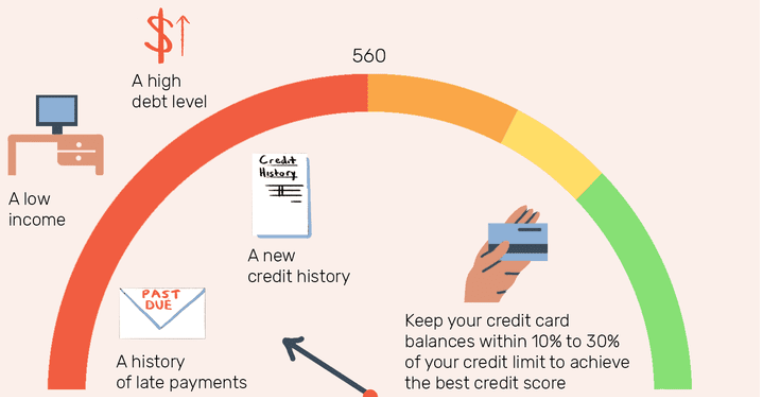

For balance use of your credit card, you should use a maximum of 30% of your total available credit. Using more than 10% of the credit will make you lose some of your credit scores but 30% or more usage will definitely make you lose a lot.

Generally, it is best to use less available credit because if you use a large amount of available credit then you will have difficulty repaying the debts.

Credit Utilization Ratio

The Credit utilization ratio is the amount of revolving credit you are currently using to the total amount of credit available to you. In simple words, it is the amount you have to repay divided by your credit limit. It is also termed the credit utilization rate.

For Example, if your available credit is ₹ 20,000 on your credit cards, and the balance remaining on your credit card is ₹10,000 it means your credit utilization ratio is 50% as you have used half of your credit available.

There are tons of factors that help us to determine the right utilization rate. These factors include your financial health, the total number of your credit accounts, and your credit reports.

Ways to reduce credit utilization ratio

The credit utilization ratio can be reduced in two ways: by lowering the credit balance or by increasing the total credit limit.

Lowering credit balance: paying off your debts and avoiding new charges will reduce your credit utilization ratio.

Increasing Total credit limit:

Ask for an increase in credit limit for your cards or apply for a new credit card, these are the ways to bring your utilization ratio down.

The right amount of credit to be used

Maintain your utilization ratio of less than 30% to achieve a good credit score. But these things won’t help you get better credits. Always consider your spending habits, if you don’t want to get negatively affected by your credit utilization. Use less of your available credit to increase your credit score. Don't forget that your overall credit utilization is very important as you don't have only one credit utilization rate. Each of your account's credit rates can affect your credit score.

Bottom Line

It is always advised to underutilize your Credit limit. Do not get carried away with using too many credit facilities as these will have an impact on your income-to-debt ratio and can hurt your credit score. Use your credit cards and bank overdraft facilities wisely.

Comments

Post a Comment