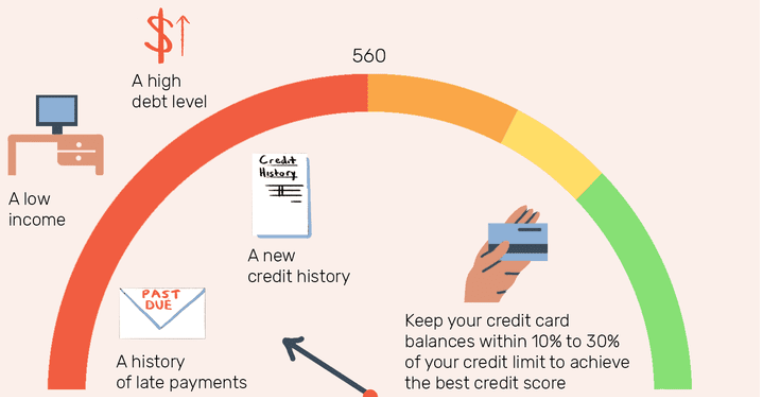

Major Factors That Affect Your CIBIL Score

A credit score is a crucial factor that is reviewed when you apply for a credit card or for a loan. It is a 3 digit number that determines your credibility. Here are some major factors that can affect your CIBIL Score that you must be aware of. Keep reading to kick start your research. Not paying credit card bills on time: It is crucial to pay the credit card bills on time and in full. If you keep defaulting in the repayment cycles then it will affect your credit score negatively. To avoid this from happening you can choose to register for the auto-debit services and you do not have to worry about remembering the due dates. The high credit utilization ratio: Another important aspect that you need to keep in mind is not using your credit limit completely. It is advisable to maintain a credit utilization ratio between 30% - 40%, more than this will eventually harm your credit score. To avoid this situation you can set a threshold limit on your credit card so that on reaching that...